JA Finance Park®

EMPOWERING STUDENTS TO TAKE CONTROL OF THEIR FUTURES

JA Finance Park provides students the unique opportunity to experience their personal financial futures first-hand. JA Finance Park helps students build a foundation upon which they can make intelligent financial decisions that last a lifetime, including decisions related to income, expenses, savings, and credit.

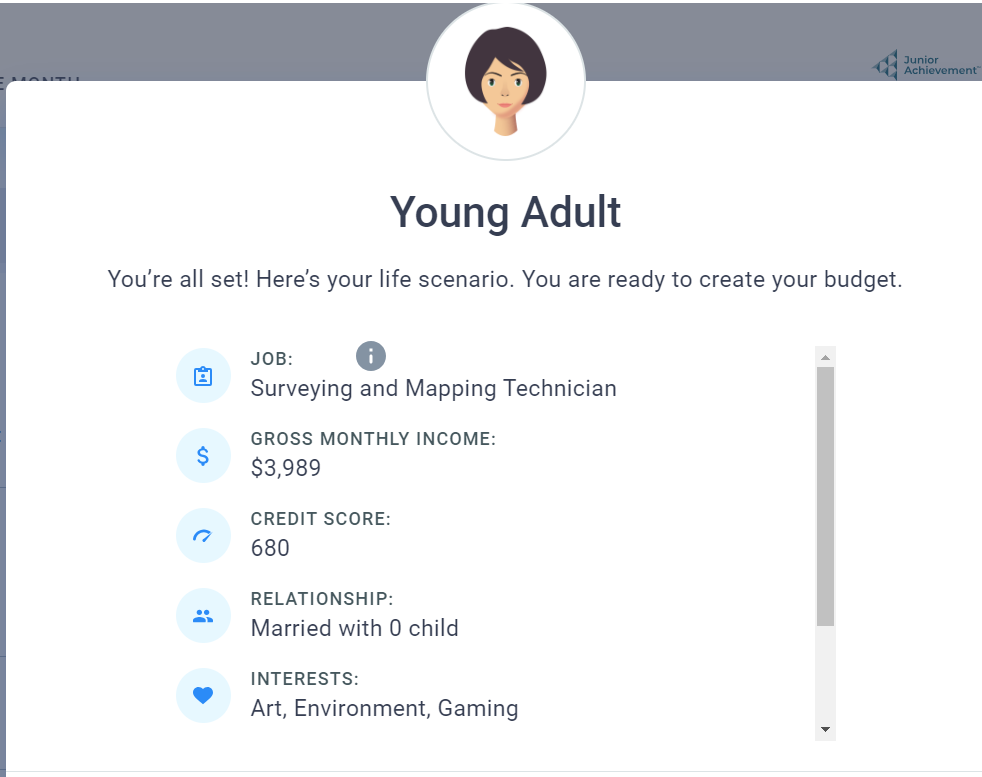

After in-class lessons, students participate in an immersive simulation that enables them to develop skills to successfully navigate today’s complex economic environment and discover how decisions today can impact tomorrow. Students will all be assigned a fictitious ‘life scenario’ with a career, salary, debt and family size. They visit storefronts representing the major line items in a budget – housing, utilities, food, etc. – and work towards providing for themselves and their families within their assigned means. Throughout the day they apply for auto and home loans and discover the impact a credit score has on financial well-being. Volunteers guide students through the simulation and provide their own life experience to bring authenticity to the experience.

JA Finance Park can be experienced in multiple ways: In-person at our Experiential Learning Center in Hillsboro, Oregon, or virtually from the students’ classrooms.

SIGN UP TODAY FOR JA FINANCE PARK or JA FINANCE PARK VIRTUAL

Our Curriculum

JA Finance Park offers two unique experiences tailored for middle school (Entry Level) and high school (Advanced Level) students. ALL curriculum, digital resources and training is provided to the educators.

Entry Level (grades 7-8) – Twelve in-class lessons prior to the park visit (or virtual simulation). Click here for more details on the Entry Level program.

Advanced Level (grades 9-12) – Seven Foundational in-class lessons and 21 optional Extension lessons prior to the park visit (or virtual simulation). Click here for more details on the Advanced Level program.

“I was legitimately blown away by the breadth, the depth, and the volume of financial education we covered. We really went deep with these students in a way that I wish I would have had when I was their age. And fortunately, they were very receptive to the activities and the learnings. Made me think that the opportunity is there for more financial education, and the need is of course urgent. The program you have put together went far beyond anything I’ve been a part of before. It was very, very impressive.”

— Jacob, JA Finance Park Volunteer

Already involved? Check out our resources!

Teacher Resources

Thank you for choosing to participate in JA Finance Park! We are looking forward to working with your and your students! Click the link below to access our frequently used visit info and program forms.

Volunteer Resources

Thank you for volunteering with Junior Achievement and our JA Finance Park program! Click the link below for registration, training and site information.

Sign up your classroom.

Join us as a volunteer.

Thank you to our community of sponsors, volunteers and teachers who make JA Finance Park possible!

Contact Us

For more information about JA Finance Park or JA Finance Park Virtual,

please contact Gina Huntington, Senior Director of Education, ghuntington@ja-pdx.org